It’s the beginning of a new year and, like clockwork, trends from the past year and predictions about the upcoming year start circulating. This can be extremely useful for any business as analysing business and economic trends, from multiple points of view, will help with business planning and prioritising for the new year. To read more, take a look at our B Corp Value for Investors to discover more business insights.

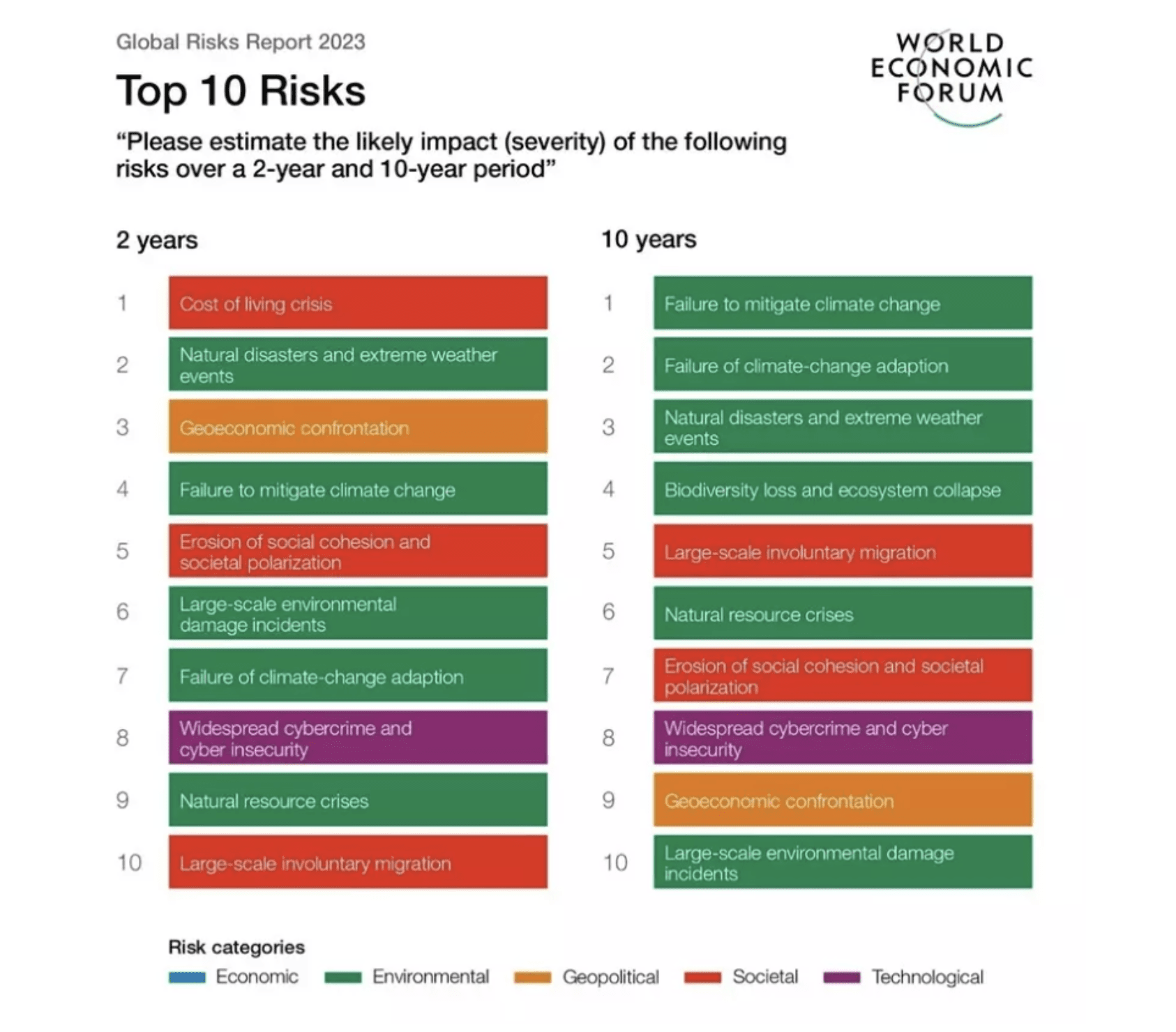

The World Economic Forum produced a list of the top risks, over the short and medium-term outlook.

Social and environmental risks are expected to have an enormous impact on businesses. The best ways to mitigate those risks are by better understanding and improving the impact businesses have on society and the environment. At Seismic, we help businesses to understand and better navigate these risks. For more information and start your certification journey, visit our B Corp page here.

Some key impact trends in 2023

- Corporate & ESG strategies converging

- Attracting & Retaining Talent is Important & Tough

- ESG budgets remain flat for 2023

“Continue with your ESG [strategy], don’t park your plans…we know this is one of the toughest business cycles, but those who can maintain momentum will do better to weather this storm.”

– Andy Schmidt, Cofounder and Chief Community Officer, Seismic

Trend #1: ESG is on the agenda

Forbes put out their predictions for 2023 and, following a survey of 2,600 CEOs, they found 98% agree that ESG is core to their roles.

It’s only been in the last 3-5 years that the business strategy has been feeding into the ESG strategy, not working in silos. We’re seeing more and more businesses now have a fully integrated approach to ESG, with the business strategies being inclusive, and organisations being built around ESG focus and priorities.

Trend #2: Recruiting & Retaining Talent

A UN survey of more than 2,600 chief executive officers globally, found that competition for talent was going to be a top challenge in the year ahead. 70% indicate talent scarcity will have a high or moderate impact on their business in 2023 (UN Global Compact-Accenture CEO Survey)

Recruiting & retaining talent, following the great resignation and during a cost of living crisis, means attracting and keeping good talent is increasingly challenging for businesses. Running a business, in general, is more expensive, and staff need higher pay in order to maintain their quality of life, so companies are going to have to develop different ways, besides increasing salaries, to attract and keep new talent. The B Corp framework could be what a business needs – 70% of candidates recruited by B Corps mentioned it in their interview process (B Corp Community Survey 2019).

*** Top tip – If you want to significantly reduce your recruitment efforts, make sure you leverage your ESG efforts, by communicating them internally, as well as externally.

Having considered the minimum wage and the cost of living crisis, B Lab came up with an ‘inclusive economy’ challenge, a plan for supporting underserved communities. If more and more companies could follow some best practice guides (all linked below) people and the larger economy would benefit.

Trend #3: ESG budgets remain flat in 2023

Another trend in 2023 is that ESG budgets are remaining flat – and that’s amazing! In a struggling economy, where businesses, be that multinationals or SMEs, are having to make really tough decisions and often cuts across the board, they are not planning to decrease the amount their business invests in ESG in 2023, compared to 2022.

ESG is becoming seen as a core business function. Andy Schmidt, from Seismic, said “Please try as you might to continue with your ESG, don’t park your plans, we know this is one of the toughest business cycles, but those who can maintain momentum will do better to weather this storm.”

Leveraging the B Corp framework

Some companies have found innovative ways of tying the B Corp framework to their ESG strategies and their every day business operations:

- Creating KPIs related to the their social and environmental performance, which are signed off by the Board and, later, their progress reviewed by the Board

- Integrating ESG-related KPIs into key business performance mechanisms like individual performance reviews, company scorecards and executive compensation

- Maintaining external transparency and accountability, including annual impact reports

These aren’t predictions, but real-life examples of how B Corps are currently leveraging the B Corp framework. Given the 2023 trends above, if you haven’t started innovating on how you’re using the B Corp framework, now is the time to start. If the trends play out and the majority of the market does in fact continue to invest in measuring and improving their ESG performance, those forward-thinking businesses that maintain their momentum will be in a better position than those that do not.

Insights from Katie Hill, Board member of B Lab Global and policy advisor to B Lab Europe

As a board member of B Lab Global and policy advisor to B Lab Europe, Katie Hill has a unique perspective on the environment and the macro-environmental challenges that businesses are going to be facing in the year ahead.

Here are eight of her key observations:

- There’s always hope. We’ve faced these kinds of crises before, for example, the hole in the ozone layer was a big issue in the 80s/90s and through awareness and behaviour change scientists are on their way to reducing and fixing that issue. So nothing about this planet is without hope. We just need to be open to change, focus our mindset and work together.

- Collaboration is key. Real trend drivers are individual businesses desiring more regulations. None of us are isolated entities. Changing ESG reporting standards, to bring them in line globally helps the entire economy. Policies and regulations will support business growth and support opportunities.

- Citizen consumers. The role of consumers is changing, we could be more imaginative in how we view our relationship with consumers. We can work together, co-create solutions and look at what we could do differently. The tech industry is standing up to hostile content online and prioritising the B Corp ethos.

- Finding shared goals. B lab pulled crowd-sourced information together by working with industry leaders. The SDG Actions support organisations to find a common language and have identified 17 common goals businesses need to hone in on.

- Reducing hierarchies. Leadership is going through a huge re-think. More businesses are flattening their structures to better deliver their inner development goals by taking human qualities and protecting their precious human talent. This is all about co-creation, a firm part of the B Corp world.

- Joining forces. More companies (over 50 now) within the beauty industry are trying to change the industry for good. Examining the need for better regulations, less greenwashing and reducing the amount of chemical waste. All of these companies could be competitors, but by working together, they can improve the beauty industry permanently. Large and small, all contributing to the debate.

- Making space for more voices. Boardrooms need a shake-up. It can be hard to navigate businesses strategically and offer a supportive role. Who’s voice is around the table and how we are managing things now and in the long term needs considering. Making space for younger people and thinking about how they can best inform what the business is going through, transforms the board into powerful agents for change.

- Listening to the academic perspective. Students are always looking for more research opportunities. Make the most of them. Getting a third party to take an academic look at how to make process changes and see the problems that may be right in front of you.

Resources

Practical guides and resources for follow-up reading, to support everything covered in our event are linked here:

How Seismic can help you leverage B Corp in 2023

We partner with organisations to help them build top-tier ESG strategies using the B Corp framework. We can help you get started and integrate your core business strategy with your ESG strategy to drive long-term positive change. Get in touch.