Sustainability reporting is becoming increasingly mandated, and with it comes a complex web of disclosure requirements. One of the key elements of the new Corporate Sustainability Reporting Directive (CSRD) is the concept of “double materiality”, and understanding how to navigate it is key to turning compliance into commercial value.

In this blog post, we’ll uncover what double materiality means, how to use it within CSRD, its commercial opportunities and Seismic’s recommended approach.

Understanding Double Materiality

The CSRD, the overarching framework for sustainability reporting in the EU, encompasses over 1,000 data points across 12 topical standards. However, not all of these data points are equally relevant to every business.

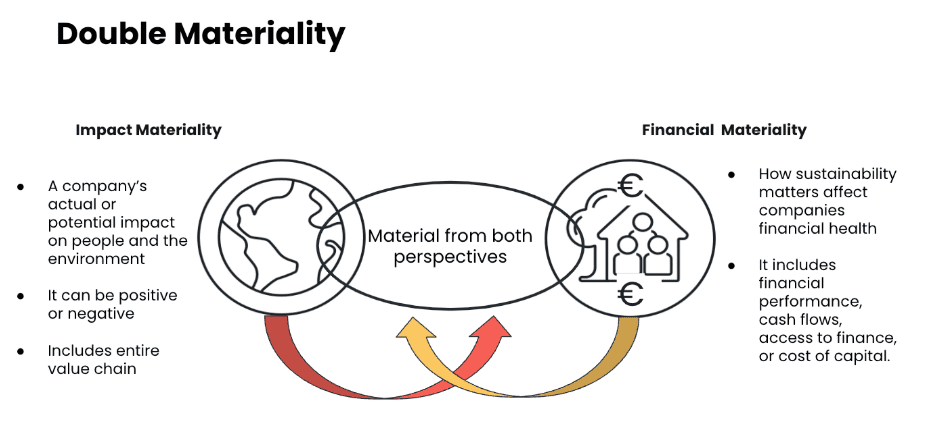

Double materiality assesses a company’s sustainability performance from two perspectives:

- Impact on the business: How environmental and social factors affect the company’s financial performance

- Impact on the world: How the company’s activities affect the environment and society

Historically, companies could profit from practices that harmed the planet or people because these costs weren’t fully accounted for. A double materiality approach therefore affirms that what is financially material isn’t the only thing that matters; companies and financial institutions need to take responsibility for how their decisions affect people and the planet.

By going through this assessment, companies can prioritise the areas that are truly critical and, most importantly, relevant to your business and its operations.

“It’s knowing what effect you’re having on your surroundings and how those surrounding factors are having a financial impact on you as well,” – Rebecca Addison, Senior Sustainability Analyst, Seismic.

Unlocking Commercial Value

When used with CSRD, the double materiality assessment provides companies with a strategic tool for identifying growth opportunities and driving positive change, going far beyond compliance.

By assessing material risks and opportunities, businesses can:

- Engage with key stakeholders more effectively, enhancing these relationships to drive commercial value

- Strengthen business strategy and future planning, by identifying key risk and financial impact areas

- Identify new avenues for innovation and value creation, highlighting where the company can improve and grow

Putting it into practice

To put this into practice, here’s an example of the impact the double materiality assessment might reveal about a company’s operations, and the resulting effects of this identification.

The assessment may reveal that a company’s plastic packaging is having a significant negative environmental impact while also exposing the business to financial risks like new packaging taxes.

From a CSRD reporting perspective, the company would need to disclose both the impact (how much plastic waste the company produces and its environmental effects) and the financial implications (costs of upcoming legislation, potential market share loss due to changing consumer preferences, etc.).

Therefore, the double materiality assessment helps businesses identify and mitigate current risks to the company and the environment. It also helps them identify future opportunities that benefit both the planet and their bottom line.

Getting started

A thorough double materiality assessment requires a structured approach. At Seismic, we recommend one that is collaborative and phased:

- Scoping: Check with your legal and auditing teams on which entities are in scope of CSRD requirements

- Identify impacts: Using the ESRS topic lists,identify which topics are likely to be material to your business. You can understand this by looking at your peers, your previous reports, and gauging if a topic is going to be relevant to your business

- Set up a double materiality steering group: Identify and bring together key internal stakeholders who are likely to be decision makers; e.g. COO, CFO, Head of People, CMO, Heads of business units/entities

- Engage external stakeholders: Identify valued external stakeholder input, e.g. key suppliers, customers/clients, NGOs, etc.

- Conduct assessments: Go through the appropriate assessments to work out how material each issue is to your business in terms of impact and financial materiality

- Document and validate: Ensure proper documentation and governance for assurance purposes

- Confirm material topics: Based on the assessments conducted, produce a list of material topics

- Develop a roadmap: Create a plan to report on, and then address, the most material issues

By following this process, companies can fulfil their CSRD reporting requirements and discover new ways to drive commercial value while prioritising impact. It’s a win-win situation that forward-thinking companies are already starting to capitalise on.

Turning risk into impact

Ready to get started with your double materiality assessment? Our team are experts at making the complex simple and digestible, offering flexible support tailored to your needs.

Whether you want us to handle the entire process or strengthen your in-house expertise through coaching and support, we’ll help you turn CSRD compliance into a strategic advantage for your business. Get in touch with one of our experts today.