Whether you’re at the start of your sustainability journey or refining an existing approach, defining an ESG strategy is the first step to actionable change. In our recent Breakfast Briefing, Seismic’s CEO, Paul Lewis and Sustainability Consultant, Ali Perry, are joined by sustainability leaders Claire Rainsford, Head of Sustainability at Taylor Wessing, Evan Laframboise, Senior Manager at Altum and Alina Darragh, Global Environmental Program Director at WD-40 Company, to discuss how to define a strong ESG strategy and share insights from their own ESG journeys.

What is an ESG Strategy?

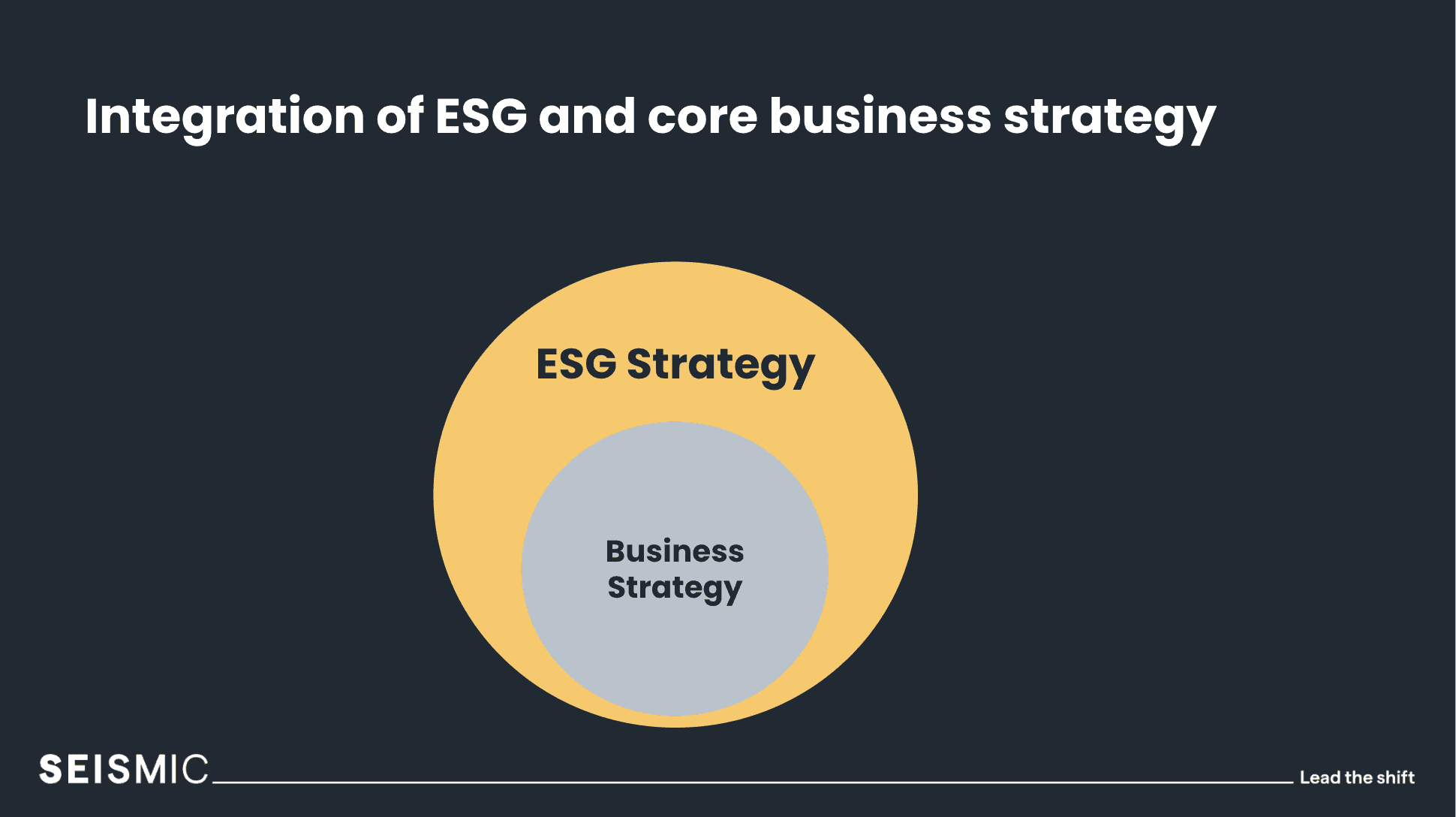

An Environmental, Social and Governance (ESG) strategy is a vehicle for change, a business model that prioritises responsible and sustainable decision-making and serves as a framework to translate aspiration into action. In today’s world, integration of business strategy and ESG strategy is essential. The two frameworks cannot be separate priorities.

Why is an ESG Strategy so important?

An ESG strategy encourages growth, enhances resilience and strengthens customer engagement.

The Purpose Dividend report states that there will be an estimated impact of £149 billion a year boost to GDP if all businesses were purpose-led, with research showing that companies that have taken their sustainability strategies the furthest are doing the best.

Customers today expect transparency, responsibility and action from companies, with 76% of people who think business has a responsibility to people and planet.

The power of a strong strategy

An integrated sustainability strategy builds the foundation for businesses across the following 6 areas:

-

Accountability: ensuring a commitment to responsible ethical practices

-

Engagement: two-way communication with internal teams and external stakeholders

-

Focus: having priorities in order

-

Resilience: managing risk proactively whilst adhering to best practice

-

Momentum: using a roadmap to focus on the next steps

-

Impact: how the strategy maximises your sustainability impact

Using this as ‘sustainability toolbox’ helps structure a strategic approach, working as a review cycle to continuously understand your process and progress. To get started, follow these three steps:

Measure your baseline: Seismic believes the B Corp framework is the most effective, holistic tool in order to accurately measure your baseline across the entirety of the business. This will guide you in consulting relevant stakeholders and help to identify where your blind spots are. It ensures nothing is missed, whilst providing a clear view on what areas to focus on first.

Refine your business’s mission, vision and purpose: Refining your mission, vision and purpose is an important element for an ESG strategy, as it allows a business to articulate and set goals for the future. This helps to gain buy-in from the Board and leadership team, by considering what is important and relevant to senior leadership, helping to prioritise and move forward.

Create a roadmap that supports the creation of an action plan and targets: Resourcing and funding need consideration, alongside distributing team accountability. This is all within the project management of getting the strategy into action, an essential step to support engagement with your largest team of stakeholders, ensuring shared responsibility.

Insights from an expert panel

Seismic curated a discussion with sustainability leaders who shared the impact ESG strategies have on real companies.

- Paul Lewis, Seismic’s Cofounder and CEO was joined by:

- Claire Rainsford, Head of Sustainability at Taylor Wessing,an international law firm

- Evan Laframboise, Senior Manager at Altum,provider of asset and corporate services

- Alina Darragh, Global Environmental Program Director at WD-40

- Ali Perry, Sustainability Consultant at Seismic

How does an ESG Strategy impact real companies?

There was a unanimous agreement regarding the value of a Materiality Assessment. The assessment always reveals that perceived impacts on sustainability were different from reality. Involving internal and external stakeholders in the analysis garners positive feedback and motivated participation, emphasising the importance of communication throughout the process.

Alina stressed the importance of listening, “listening to your stakeholder’s priorities and bringing them on that journey is essential. They need to feel part of your process… that’s the key. During Materiality, don’t focus on what you’re going to tell them, but what you’re going to ask them, is an important part of this process.”

Leadership teams often believe they know a company’s priorities, but hearing from stakeholders is always insightful. Materiality Assessments provide 360 feedback and completing those assessments regularly is recommended. Annually or bi-annually, they help to re-engage stakeholders, bring on new perspectives and consider external industry influences.

Companies working beyond profit

Companies bringing value beyond profit-making is inspiring for all involved.

Claire highlighted, “As lawyers we’re really beginning to realise that what we advise on can make an impact in the volume of deals we do. Looking at a company’s Scope 1 and 2 emissions are easiest to measure, so a good starting point, but value can be added from us knowing 90% of emissions can be in a company’s supply chain. We’re realising now that it’s beyond Scope 3, in our advised emissions, and what we’re enabling to happen are where the biggest potential positive impact is. We’re rating client deals and starting to think differently about carbon economy, new tech and looking at scaling up renewable energy.”

There is no one-size-fits-all strategy

Evan emphasised the importance of risk rating for clients based on standard asset risk, climate risks and regulatory risks. There is a need to be patient, set a clear roadmap and clear timelines.

Our panel discussed how scaling activity around the size of your business is essential. Doing something is better than nothing, and frameworks can help with that scale management. Smaller companies don’t need to compete with industry leaders from the start. Short-term achievements can contribute to long-term ambition.

Overcoming challenges

In terms of how to get started, Alina shared: “We cannot save the world at the first turn, and we cannot change from day one. So doing something, showing your commitment, and actually following your path to reduction… that’s something we have to strive for.”

Evan dispelled the notion of being able to handle everything in-house, “ESG is an absolute beast of a topic… Don’t be scared to put up your hand and say, ‘I don’t understand’. Reach out to consultants, reach out to other experts in their field. Just collaborate. I think a collaborative approach is key.”

Top tips from our experts

- Materiality assessments provide valuable insights, and are a great place to start in defining what your ESG strategy should look like

- Integration of business strategy with ESG strategy is essential – their alignment will lead to overall success

- Allow stakeholders to ‘weigh in’, in order to gain their ‘buy in’ – strategic thinking is a collaborative effort

- Don’t let fear of the unknown stop you from embarking on the journey. Speak to experts in the field and collaborate with other businesses to learn as you go

- Stay curious to find value in opportunities

Watch The Recording

If you missed the Breakfast Briefing, you can watch the recording below. Seismic’s monthly Breakfast Briefings aim to inform, educate and inspire our community. Sign up for our monthly newsletter to receive invites to upcoming events.

Your Sustainability Partner

Seismic supports businesses to get started on their ESG strategy. As your partner for change, we make the complex simple with clearly defined targets and actionable steps to bring your ESG strategy to life. Speak to our ESG experts.