The reporting and disclosure landscape is continuing to evolve, calling for accountability and challenging organisations to produce in-depth strategic sustainable initiatives to mitigate negative effects and drive positive business impact.

In our recent Breakfast Briefing, Seismic’s Head of Sustainability Communications, Olivia Hill and Head of Impact Development, Ro Egglesfield, were joined by sustainability leaders Mark Brown, Sustainability & Impact Manager at Motability Operations and Jo Fackler, Manager at Impact Management Platform to uncover actionable steps to start your reporting and disclosure journey with a calm, proactive approach.

In this recap, discover what was covered to demystify the reporting and disclosure landscape.

Why is reporting and disclosure important for businesses to consider?

Proactive reporting, whether through voluntary frameworks and certifications from bodies like the Science Based Targets Initiative (SBTi) and B Lab, or going through early preparation for mandatory reporting, such as Task Force on Climate-related Financial Disclosure (TCFD), empowers better business strategies by identifying how to turn risk into positive impact.

Businesses that comply to regulatory frameworks and requirements open themselves up to a number of benefits, such as:

- Increased stakeholder engagement – creating positive impact increases commercial value, with stakeholders demanding more data. By complying with regulatory requirements and frameworks, businesses increase their transparency and trust with stakeholders.

- Improved resilience – By reducing the risk of non-compliance and supporting better management of climate and societal risks, businesses are setting themselves up for success, future-proofing their business and strategy for the long run.

- Investor attraction – Reporting and disclosure act as a critical lever in the decision making process for investors, enabling quicker and easier decisions due to a level of compliance met via transparent, accurate data disclosure.

What reporting standards, frameworks or certifications apply to your organisation?

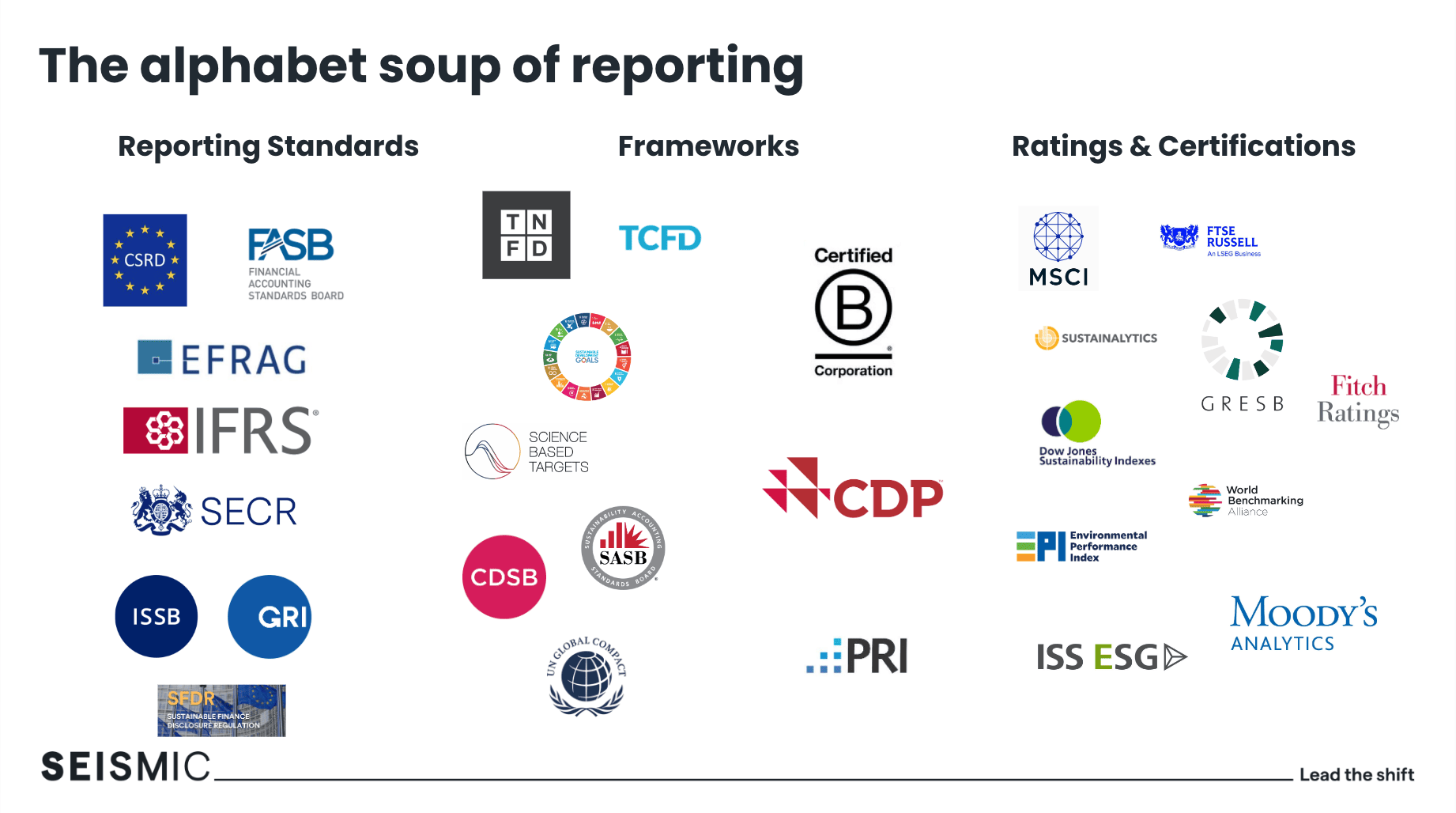

Over the last five years, regulatory reporting frameworks have doubled with over 600 different sustainability reporting provisions in place. This can make the landscape feel increasingly overwhelming, without a clear understanding of which framework is right for your business.

Seismic’s reporting experts recommend filtering through this ‘alphabet soup’ by focusing on the following six key areas when refining the reporting landscape for your organisation:

- Mandatory disclosure – understand what reporting frameworks are or will be mandatory for your business, covering your bases.

- Materiality – understand and prioritise what is meaningful and material to your business to make an effective first step.

- Ambition – Align reporting frameworks with your overall business strategy to be clear on your vision and pace.

- Sector – Ensure you understand what’s important to your sector, including industry best practices and standards that resonate amongst your stakeholders

- Long-term impact – define what supports long-term impact, not just near-term performance measurements to create a future-proof plan for success.

- Momentum – it’s vital that any voluntary framework you choose regularly evolves its standards to improve sustainability performance, supporting continuous improvement for your business to drive impact and importantly commercial growth.

The reporting and disclosure horizon

Creating a global baseline: the gold standard

In 2021, the International Sustainability Standard Board (ISSB) emerged as the global baseline for consistent and comparable sustainability-related reporting standards. This has increased alignment in the reporting landscape by integrating the Sustainability Accounting Standards Board (SASB), and industry-specific disclosure standards across the issued topics, including taking over responsibilities from the TCFD.

The ISSB considers and aligns with the Global Reporting Initiative (GRI) and the European Sustainability Reporting Standards (ESRS), amongst other major global reporting standards. This gold standard helps to clarify the future of corporate reporting converging commercial sustainable strategy and governments, and a coming together of financial and non-financial reporting and data management.

Businesses operating in Europe

The key mandatory directive driving mandatory reporting within Europe is the CSRD, which has similar requirements to the ISSB.

The CSRD was informed by the European Financial Reporting Advisory Group (EFRAG) effective in January 2023 and was passed into EU legislation for annual reporting periods in January 2024. It’s the result of the development of a harmonised set of sustainability reporting standards for companies operating in the EU.

CSRD is anticipated to affect over 50,000 companies by 2027. That includes SMEs both in and outside the EU, involving retrospective and forward-thinking reporting. It has 1,000 European SRS data points across 12 standards and under four pillars and is based on materiality with assurance, and reports from across the entire value chain, upstream and downstream.

Double materiality

A key area of the CSRD that underpins the ESRS is the concept of ‘double materiality’. This is a fundamental strategic activity that companies can undertake to be proactive, focusing resources internally and supporting efficient reporting by engaging stakeholders in determining the most material sustainability topics within a business.

Double materiality is the consideration of a company’s impact on sustainability matters – an inside-out approach – and the sustainability matters’ financial impact on a company’s development, performance and position – an outside-in approach. This enables an organisation to have a more holistic view of its risks and opportunities.

UK Sustainability Disclosure Standards (SDS)

The UK Sustainability Disclosure Standards will set out corporate disclosures on the sustainability-related risks and opportunities that companies face.

Due to be created by July 2024, coming into effect by January 2025, the UK government has stated that these standards will be based on the IFRS Sustainability Disclosure Standards, issued by the ISSB, and will only divert from the global baseline if necessary for UK specific matters.

How to get reporting ready

With a whole host of considerations when it comes to reporting, Seismic breaks down how to get started on your reporting journey with 3 key things to consider to create a reporting pathway:

- Define your reporting and desired framework – review your legislative landscape, peer reporting and benchmarking in line with your stakeholder needs and expectations. Following this by completing a framework review to select the most meaningful disclosure frameworks in a mapping exercise.

- Understand your current reporting and data – review your reporting governance, resources and processes with a data audit to understand current measurement and your data and reporting baseline.

- Complete a gap analysis – this will provide you with the roadmap on key steps that need taking to meet your ambitions and drive impact and value through reporting and disclosure

A conversation with reporting and disclosure leaders

Ro Egglesfield, Head of Impact Development at Seismic, led the discussion with

Mark Brown, Sustainability and Impact manager, at Motability Operations Ltd, an organisation that enables disabled people across the UK to access mobility solutions.

Joining Ro and Mark was Jo Fackler, Manager at Impact Management Platform – a collaboration of 19 international leading providers of sustainability standards and guidance that are coordinating efforts to mainstream the practice of impact management.

The benefits of a materiality assessment

Mark shared experiences from Motability Operations’ reporting journey, who were already in compliance with several frameworks and had its near term Science Based Target approved, whilst working towards B Corp certification.

He highlights that to understand which frameworks were most valuable to them, the business undertook a materiality assessment. This involved speaking with their key stakeholders to understand what is important to them, learning more about the challenges that suppliers face and the attitudes of customers.

Motability used this knowledge to inform sustainability reporting as well as initiatives and strategies in other areas of the business, including how to engage the whole organisation with the value of their reporting activities.

How the ‘standard setters’ are working together

Jo from Impact Management Platform highlighted three key areas that are at the forefront of the standard setting discussions:

- Collaboration – Jo highlighted the need to collaborate as a group to gain further clarity, demonstrate unitedness and commitment to driving impact management forward. This is at the forefront of a political and economic volatile backdrop and we need to make the case for sustainability.

- Prioritisation – Prioritising the alignment of the disclosure standards with practice frameworks and standards. Jo spoke to the difference between these two areas, from disclosing data to practically managing impact and that there is a risk of overwhelm, and resulting cost to compliance, if reporting frameworks aren’t strategically aligned with practicalities of how to integrate disclosures within the business.

- Process – Jo’s third point was on the importance of making impact management a mainstream process. Impact management must include leaders across sectors and industries, from policy makers, governments, practitioners and business leaders in order to increase transparency and align best practices.

What are the challenges companies face in reporting?

Mark highlighted the specific challenge of data collection, particularly with regards to value chains and third party carbon reduction. He mentioned that this will improve over time as companies’ sustainability maturity increases, but right now, it can be challenging to understand the entirety of the data accuracy across a business’ supply chain and stakeholders.

Jo reminded us that if a company is already starting to collect sustainability related data, they are off to a great start in their reporting journey. By gathering data that is in accordance with voluntary standard setters, they are far more aligned with mandatory reporting requirements such as ISSB and CSRD, and are one step ahead.

Mark highlighted the crucial point of making reporting and disclosure a fundamental part of a business strategy. It is not tomorrow’s problem, it’s yesterday’s problem, and integrating reporting into the business enables risk mitigation and a smoother experience for creating lasting change.

Watch the recording

If you missed the Breakfast Briefing, you can watch the recording below. Seismic’s monthly Breakfast Briefings aim to inform, educate and inspire our community. Sign up for our monthly newsletter to receive invites to upcoming events.

Partnering with Seismic

Seismic supports businesses to develop their reporting and disclosure strategies. As your partner for change, we turn an ever-evolving landscape into actionable language with a pathway for success. Speak to our reporting and disclosure experts.